Clean label is securing its spot in the world of on-pack messaging. Innova has published a report on current clean label developments showing how the term is perceived globally, who it matters to most, and where it’s headed next.

What Does Clean Label Mean?

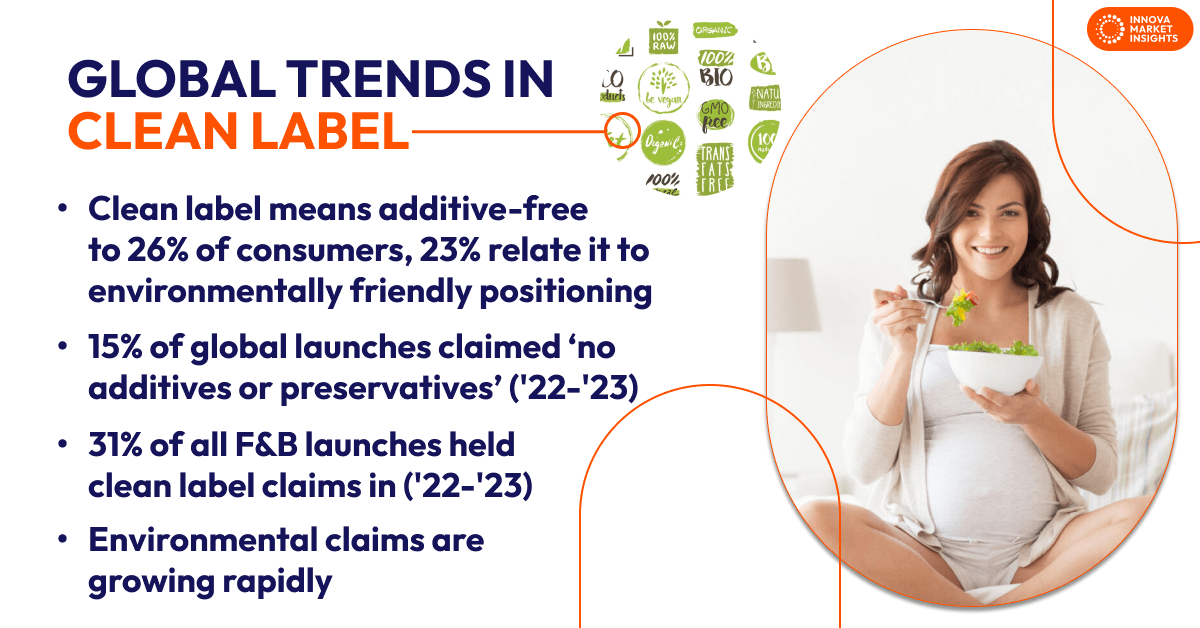

The idea of clean label began with the anti-additive movement but now holds much more meaning, with relevance now holding to health, transparency, and the environment. While 26% of consumers relate clean label to additive-free recipes, 23% say it relates to environmentally friendly positioning. Regional opinions also vary. While environmental associations are strongest in Asia, the emphasis on additive-free products could be greater elsewhere. 57% of consumers say they are at least moderately engaged in environmental action. Health is still a significant clean-label target all over, with positive health credentials involving natural and additive-free recipes. Besides health, ingredient transparency is progressively important, with 3 in 4 consumers wanting companies to be transparent.

Out with Additives

Almost 15% of new food and beverage products globally carried ‘no additives’ or ‘no preservatives’ claims in 2022 and 2023. Penetration was shown to be highest in Australasia, but in Australasia and most other regions, the use of these claims has fallen, leaving only Asia to display solid growth.

Categories with the highest penetration of additive claims include those aimed at children and those offering complete everyday nutrition or hydration. Categories with the lowest penetration of additive claims are pure indulgence categories such as confectionery and alcoholic beverages.

Additive claims appear less important than they once were, and in products where there is likely to be a positive expectation of their removal. Some brands are shifting this information to the back of their packaging. Another additive claims trend is that claims can be less formal nowadays, using phrases such as “no junk” or “no bad stuff.”

In with Clean Labels

Although cost, convenience, and flavor are still the top considerations in food purchasing, clean-label themes related to health and naturalness prove to be of similar significance. Naturalness is most important in Latin America and Europe and least relevant in North America. Another clean label trend is that clarity is in high demand. Whether consumers want more detail or would prefer things to be simplified, there is still an almost universal desire for information. Nearly 2 in 3 consumers said that clean labels had at least some impact on their purchasing decisions when surveyed. Additionally, 50% of consumers say they would pay more for clean labels, up slightly from 2022 to 2023. Asians and Latin Americans over-index, with only around 1 in 3 North Americans and 37% of Europeans saying they are prepared to pay extra.

Clean Label Trends in NPD

31% of all new food and beverage products launched in 2022-2023 carried a clean label claim.

However, the use of traditional clean-label claims appears to be declining. In contrast, environmental claims, which consumers are increasingly associating with clean label, continue to gain shares in NPD. Regionally, Australasia shows the highest penetration of clean label claims, ahead of North America and Europe. Despite high levels of consumer interest in the issue, penetration remains lower in Latin America and Asia. Clean label claims show the highest penetration in child-oriented categories, where additive removal is key, as well as in everyday processed nutrition, such as cereals, meat substitutes, soups, and spreads.

Certified Clean Labels

Certification logos are a popular way to reinforce organic or non-GMO messages because they rely on consumers’ trust. Around 9% of all new food and beverage products were certified organic in 2022-2023, with the highest penetration in Europe and North America. However, penetration is falling in all areas, apart from East Europe, where growth remains strong. The highest penetration levels of organic claims per category are in baby and toddler foods. As for GMO-free claims, almost 5% of all new products carried GMO-free claims, peaking at 18% in North America. GMO-free claims are most established in the meat-substitutes category. Overall, organic, and GMO-free claims are becoming more commonplace and used by big, small, and private label brands.

Clean and Green

Consumers increasingly associate clean labels with positive environmental credentials, appearing alongside the rise of environment-related claims in NPD. The growth trend is fastest in Europe, but all regions are seeing at least some increase in environmentally positive claims. Sustainability certification of commodities, such as coffee or cocoa, is established and is helping to boost the penetration of eco claims in areas such as hot drinks and confectionery. Plant-based meat and dairy alternatives also commonly carry environmental messages. At the same time, more specific environmental claims are also growing fast, including those related to upcycling (+81% CAGR in number of launches from 2018-2019 to 2022-2023) and carbon neutrality (+44% CAGR).

What’s Next?

“Clean and kind” could be a future focus for this category. Environmental messaging is already moving into the clean label space, but other ethical claims related to animal and human wellbeing could shift into this arena. As things advance, the cost-of-living crisis in many parts of the world could hit clean label demand unless suppliers can deliver clean and affordable in tandem. Three-quarters of consumers are concerned about the cost of living, and two-thirds have noticed rising prices.

The shift toward environmental messaging as part of the clean label movement is ongoing, but some consumers are already suffering from label overload and would prefer one label to capture the complete eco-impact. In Europe, eco scores are being developed to help with this, but there remains controversy over methodologies, and this will need to be resolved before widespread – or more international – rollouts.

This article is based on our report, “Embracing Transparency: Unveiling the Global Trends in Clean Label Products.”

If you are interested in receiving this report, feel free to request a demo through our Contact Form.