March 15, 2024 – Iced coffee trends, and iced tea trends are continually developing within the US. While iced tea has been a prominent product in the space for many years, iced coffee is fast rising and becoming a more desirable on-the-go drink for Americans.

Consumption Habits and Frequency

In the past half year, almost half of Americans purchased iced tea at least once, while one-third purchased iced coffee. Regarding the location of where most Americans purchase these beverages, supermarkets are most often the establishment of choice. However, iced coffee trends demonstrate specifically iced coffee is bought just as often in specialty stores, such as cafes and bakeries.

Iced tea is consumed slightly more frequently than iced coffee, with 30% of consumers drinking iced tea 4-6 times per week or more, while 26% of iced coffee drinkers do the same. Additionally, one third of coffee drinkers and one quarter of iced tea drinkers have increased their consumption in the past year.

As for when consumers drink these two beverages, iced coffee is most often consumed at breakfast time, while iced tea is most often consumed at lunch.

Consumer Preferences

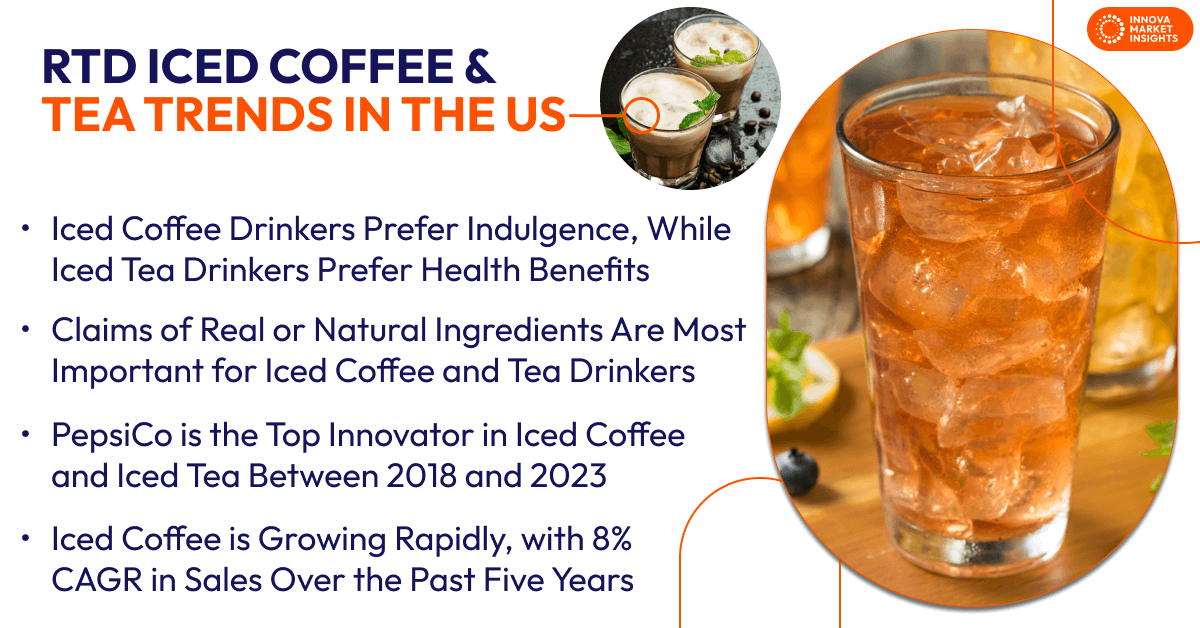

Innova’s iced coffee trend research indicates that for iced coffee, the claims of real or natural ingredients, premium quality, and indulgent elements such as specific textures or flavors are the main drivers of consumers’ purchasing decisions. For iced tea, the claim of real or natural ingredients is most important, while claims of lower sugar and without artificial flavors are slightly less impactful, but still influential.

Flavor and cost are the top attributes influencing consumer purchases of both iced coffee and iced tea. However, for consumers that have increased consumption of the drinks, health is chosen as the reason most often for iced tea drinkers, while iced coffee drinkers cite a change in their taste preference.

Iced Coffee and Iced Tea Market Size

Both the markets for iced coffee and iced tea are growing, but iced coffee is growing at a rapid pace, while iced tea is growing at a slower, steadier pace. Sales of iced coffee have grown by 8% CAGR over the past five years, and the volume produced has grown by 5% CAGR. For iced tea, sales have grown by 5% CAGR over the same period, while the volume has grown by 3% CAGR.

When measured for per capita consumption, the same trend holds true, with iced coffee growing by 5% CAGR and iced tea growing by 2%, both over the past five years. However, this discrepancy in growth may be partly due to iced tea being a more established product in the market, as it is consumed more overall than iced coffee.

Innovative Companies

Between 2018 and 2023, PepsiCo has been the top innovator in both iced coffee and iced tea, through partnerships with Starbucks for iced coffee and Unilever for iced tea. The company’s products represent 6.8% of launches in the iced coffee market, and 4.9% of launches in the iced tea market. PepsiCo stands as launching substantially more iced coffee products than any of their competitors, but for iced tea, Coca-Cola has released almost as many products, with 4.4% of product launches in the category.

Category Challengers

In 2022, Monster Beverage has released two cold brew nitro-infused coffee drink products, pushing further into the iced coffee market.

Arizona Beverages is expanding production capabilities in the iced tea market, as well as entering other categories such as sparkling water, and partnering with Heineken to release Sunrise, a hard seltzer.

Iced Coffee & Iced Tea Trends that Shape the Category

Launches of both iced coffee and iced tea have declined since 2020. Innova’s iced coffee trends research demonstrates launches declined faster than iced tea, with a decrease of 3% CAGR, but it also peaked higher than iced tea in overall launches in 2020.

The most common claim seen on iced coffee is ethical packaging. Plant-based claims have sharply increased in the past two years, growing faster than any other claim. Additionally, claims of gluten-free and no additives or preservatives have grown substantially. For iced tea, claims of Organic, GMO-free, vegan, and sugar-free have shown the largest increase, with Organic now seen on nearly half of new product launches.

Regarding ingredients, sugar and milk are seen less often in iced coffee, while sweeteners and dairy substitutes have grown. In iced tea products, fruits, botanicals, and sweeteners are all growing ingredients.

Iced Coffee & Iced Tea Trends Impact

Multiple of Innova’s Top 10 Trends for 2023 can be seen in iced coffee and tea products, and all relate to consumers’ needs for a healthy indulging experience at home or on the go. The trend of “Unpuzzle Health” can be seen through the rise in health-related claims in iced coffee and tea, responding to consumers’ increased concerns around health and immunity. “Revenge Spending” can be noticed through iced coffee and tea meeting consumer’s needs for indulging in small pleasures, offering textures and flavors that become everyday treats. Finally, “Farming the Future” materializes in the rise of fair trade, environment friendly, and Organic claims.

What’s Next

With its multiple facets of connection to growing trends in the market, Kombucha iced tea is a growing mainstay as a base for products. Its inherent health and energy features, and flexibility of combination of other functional products and flavors, make it a possible investment opportunity. There is also opportunity for a green tea revival as a carrier of antioxidant and immune protection benefits.

Iced coffee’s market is increasing for perceived healthier options, such as plant-based creamers, and alternative sweeteners. Additionally, it is further solidifying in the market as a premium indulgence, with creamy textures, exotic flavors, and premium beans.

A continual rise in demand for climate protection and fair-trade labor claims will likely additionally occur, as Generation Z comes of age.

This article is based on our insider report, “Chilled Innovations: RTD Iced Coffee & Tea in the US.” If you are interested in reading this report, feel free to request a demo.

You can do this by either booking a demo or using our Contact Form.